In the ever-evolving landscape of financial markets, seasoned investors are constantly on the lookout for new opportunities. One such avenue that has piqued the interest of financial enthusiasts is the world of illiquid investments.

Illiquidity, often considered a mysterious and uncharted territory, offers a unique set of challenges and opportunities for investors. In this comprehensive exploration, we unravel the intricacies of low liquidity, understanding its nuances, risks, and the trade-offs involved.

Investing In Illiquidity - Understanding And Managing Risk

Illiquid investments refer to assets that are not easily bought or sold without causing a significant impact on their market price. Unlike highly liquid assets, such as stocks or government bonds, illiquid investments pose unique challenges. Understanding the risks associated with illiquidity is crucial for investors looking to navigate this complex terrain.

One of the primary risks of illiquid investments is the lack of immediate liquidity when an investor decides to sell. This can result in extended holding periods, restricting an investor's ability to react swiftly to changing market conditions. Furthermore, the absence of a ready market for these assets can lead to higher bid-ask spreads, potentially eroding returns.

Mitigating these risks requires a thorough understanding of the investment landscape. Diversification becomes a key strategy, spreading risk across different illiquid assets to minimize the impact of a single investment's poor performance.

Decoding Investments - Why Some Assets Struggle With Liquidity

The factors contributing to low liquidity are multifaceted. Understanding why certain assets struggle with liquidity is essential for investors aiming to make informed decisions. Market depth, the size of the asset class, and the presence of institutional investors can significantly influence liquidity.

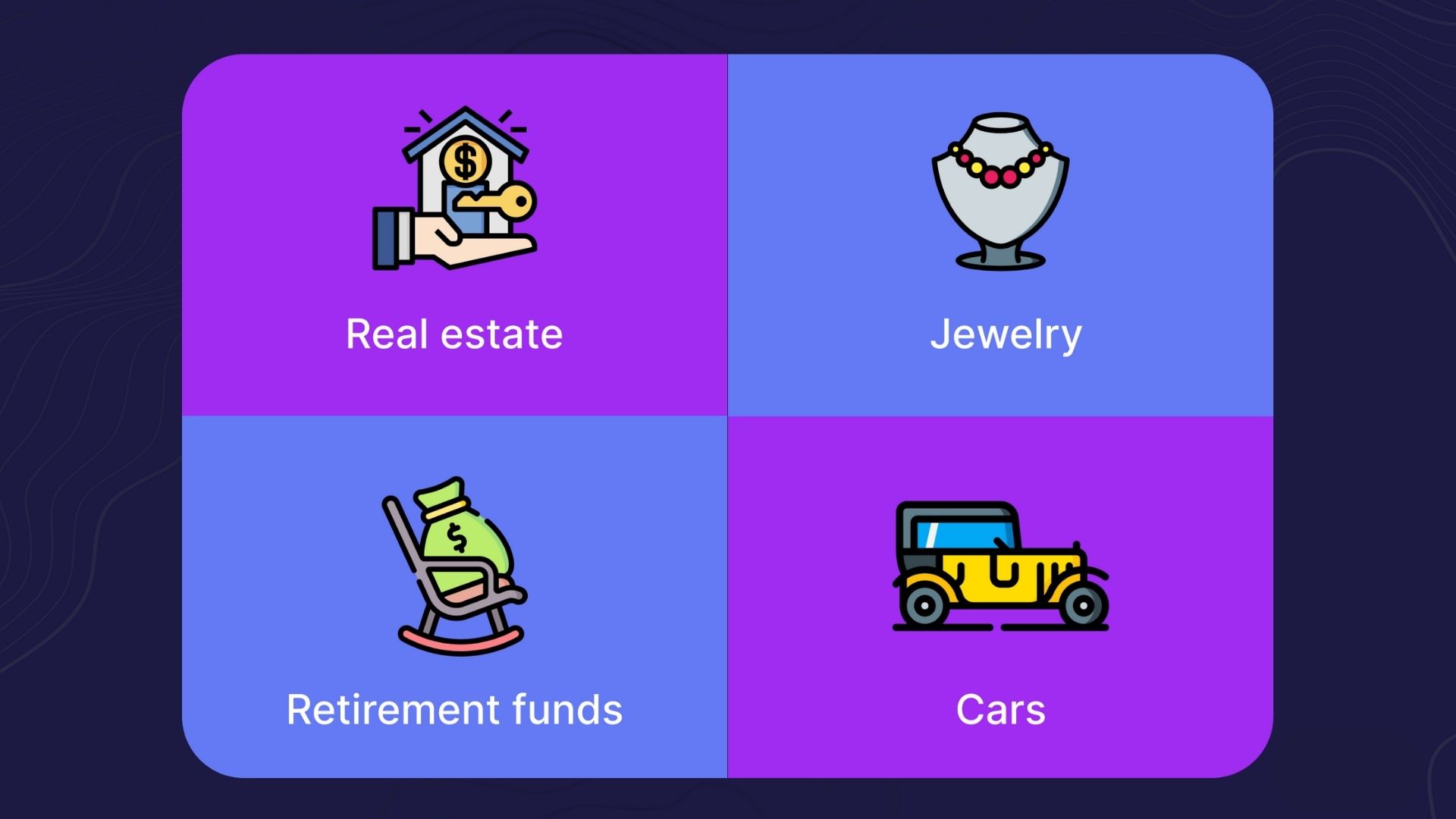

Smaller companies or niche industries often face liquidity challenges due to a limited investor base. Additionally, assets with unique characteristics, such as real estate or private equity, may lack a standardized market, making them less attractive to a broad range of investors.

Regulatory hurdles and legal restrictions can also contribute to illiquidity. Investments subject to stringent regulations may require more time and effort to buy or sell, deterring potential investors.

Risk Vs. Reward - The Trade-offs Of Low Liquidity Investments

While illiquid investments present distinct risks, they also offer unique opportunities for those willing to navigate the challenges. The potential for higher returns is often associated with illiquid assets, as investors demand a premium for bearing the additional risk and uncertainty.

Venturing into low-liquidity investments requires a careful balancing act between risk and reward. Investors must assess their risk tolerance, investment horizon, and financial goals before delving into these markets. It's crucial to weigh the potential returns against the extended holding periods and limited exit options characteristic of illiquid assets.

Behind Closed Doors - Investments With Limited Liquidity

Illiquid investments often operate behind closed doors, away from the public eye. This lack of transparency can be both an advantage and a drawback. On the positive side, it allows investors to access unique opportunities that may not be widely known. However, the downside is the limited availability of information, making due diligence more challenging.

Investors in illiquid assets must be prepared to conduct thorough research and rely on trusted networks to gather insights. Engaging with industry experts, leveraging specialized knowledge, and building relationships within the niche market can provide a competitive advantage in navigating the complexities of illiquid investments.

The Hunt For Low-Liquidity Assets - A Deep Dive Into Investment Challenges

The quest for low-liquidity assets requires a meticulous approach. Investors must be prepared to face challenges such as valuation uncertainties, prolonged exit processes, and potential delays in accessing returns. Successful navigation of these challenges often involves aligning investment strategies with the unique characteristics of illiquid assets.

Moreover, staying informed about market trends, regulatory changes, and economic shifts becomes paramount. The dynamic nature of illiquid investments necessitates a proactive approach to risk management and a willingness to adapt to evolving circumstances.

Conclusion

In the world of finance, where opportunities and risks coexist, illiquid investments stand as a distinct and intriguing asset class. Navigating the mystery of low liquidity requires a combination of astute risk management, thorough due diligence, and a strategic mindset.

As investors continue to explore uncharted waters, understanding the nuances of illiquid investments becomes not only a challenge but a gateway to untapped potential and unique financial opportunities.